In the digital age, reviews have become both the lifeblood and the poison of online products. A handful of complaints can tarnish reputations overnight, while manufactured praise can inflate expectations beyond reality. Nowhere is this truer than in the crowded world of trading software, where credibility is constantly under siege. Galileo FX, one of the most talked-about automated trading bots on Reddit and beyond, is a prime example. Despite a strong base of satisfied users and a reputation for transparency, it has not been immune to accusations of being a scam.

But a deeper look reveals that much of this criticism is less about Galileo FX itself and more about how online reviewing culture works. In fact, many of the loudest negative voices come not from honest users but from unrealistic customers, bots, and even rival companies with something to gain from casting doubt.

The Silence of the Satisfied

The first problem with reviews of any trading tool is the imbalance of voices. Happy customers rarely flood forums with praise. Instead, they either spend their time inside Galileo FX’s dedicated community r/GalileoFX_Users comparing strategies and sharing results, or they quietly use the software to supplement their income.

This creates an asymmetry. A frustrated buyer who lost money after running the bot on reckless settings might post an angry review within hours. A successful user, meanwhile, has little incentive to write lengthy defenses on third-party sites. As Galileo FX’s founder has said, the company has over 5,000 forum users. Some check in daily, some take breaks, some return after months. But most are not spending time writing reviews on Trustpilot or other aggregators. They are trading, testing, and—if their posts are to be believed—earning.

This silence skews perception. The very people who could validate the system’s legitimacy often have better things to do than argue with strangers online.

Unrealistic Expectations

Another driver of negativity is misplaced expectation. Automated trading is not magic. As the founder put it in a message to customers: “We are adults. We know how the world works. Money doesn’t come that easy.” Galileo FX does not promise to make a million dollars overnight. Instead, it provides a customizable system for disciplined trading, one that still requires decisions about risk, strategy, and asset choice.

On Reddit, this divide is clear. In r/forex_trades, satisfied users praise the bot for its stability and its ability to remove emotion from trading. “It keeps things stable and eliminates panic selling or FOMO buys,” one wrote. But elsewhere, critics complain that the software “didn’t work”—often admitting they made no effort to test settings or start with a demo account.

These users treat Galileo FX as a lottery ticket. When it doesn’t deliver instant wealth, they cry scam. In reality, the failure lies not in the system but in the unwillingness to engage with it as intended.

Competitor Attacks and Bot Campaigns

There’s another factor muddying the waters: active sabotage. Galileo FX’s dominance on Reddit has given it a target on its back. According to PR Newswire, the bot captured 56 percent of all Reddit discussions about trading bots in 2024. That kind of market share is enviable—and threatening.

It’s not surprising, then, that dishonest actors would attempt to undermine it. Negative reviews that repeat the same accusations without evidence, or accounts that appear suddenly to post only hostile comments about Galileo FX, resemble coordinated efforts rather than genuine user feedback. In an industry where dozens of competing products fight for attention, planting doubt is a cheap marketing tactic.

Many Redditors themselves have pointed this out. In r/GalileoFX_Users, community members often note that they see the same vague criticisms recycled across platforms. The suspicion is that rival firms or affiliate marketers, unable to compete with Galileo FX’s transparency and community support, attempt to smear it through fake reviews.

A Different Kind of Trading Tool

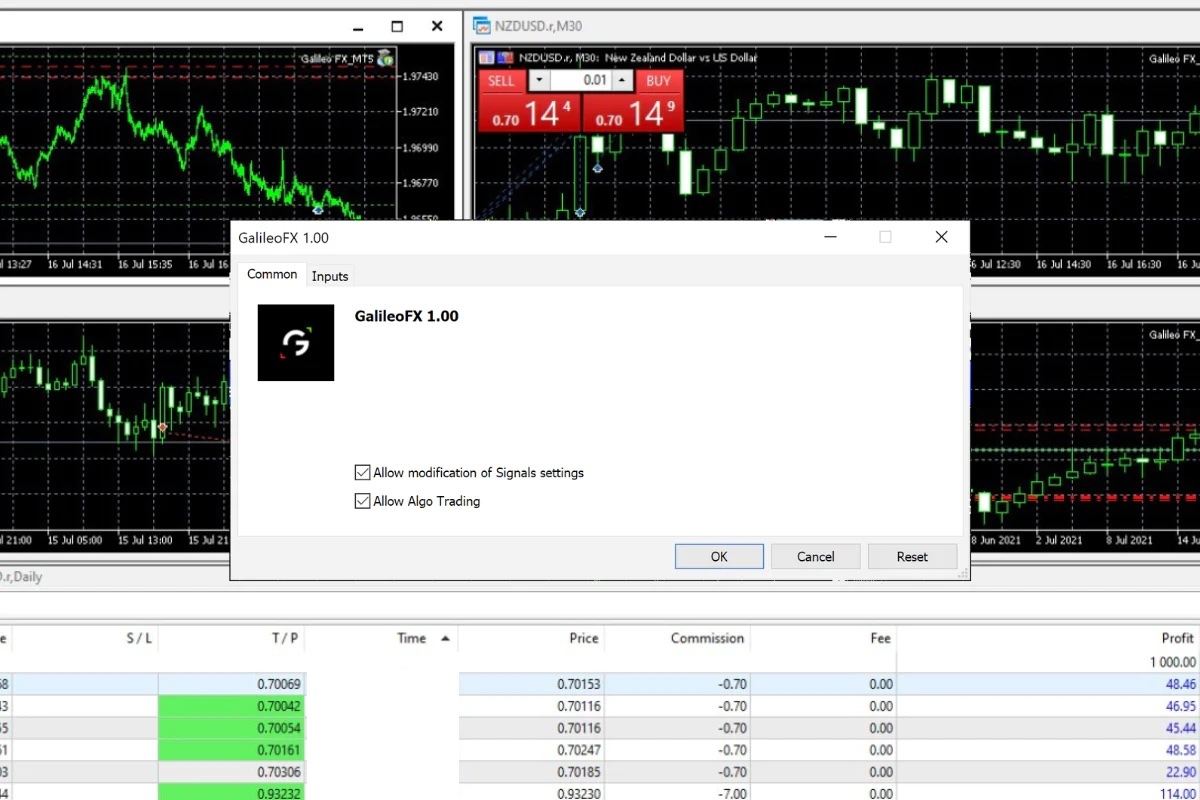

If Galileo FX were just another “black box” algorithm, accusations of dishonesty would be harder to dismiss. But its very design undermines that narrative. Users choose the assets, adjust the risk levels, set stop-losses, and decide how aggressive or conservative to be. The bot does not hide its logic; it follows parameters the trader defines.

One user on r/Forexstrategy compared the system to “a drummer in a rock band”—steady, reliable, and adaptable, but not the star of the show. This metaphor captures the essence of Galileo FX. It enforces discipline, automates execution, and scans the market tirelessly, but the direction still comes from the human trader.

The founder underscores this distinction. Galileo FX, he explained, is “like a ship. You are the captain. The software opens and closes trades automatically, but based on your direction.” That honesty—that the software is a tool, not a guarantee—contrasts with the false promises of competitors who advertise effortless riches.

Evidence of Legitimacy

Ultimately, Galileo FX’s legitimacy rests not on claims but on data. The company makes its performance results publicly available, inviting anyone to verify them. Supporters point to this transparency as the strongest argument against accusations of fraud. Unlike shady operators who hide their track records, Galileo FX publishes outcomes in real time.

The company also invests in human support, employing staff across multiple time zones to handle questions, rather than relying on impersonal AI chatbots. And it has endured since 2020—an unusually long lifespan in an industry notorious for short-lived ventures that vanish once complaints mount.

Reddit users themselves confirm this endurance. Posts across years of discussions show traders continuing to use the software, adjusting strategies as market conditions change, and reporting consistent outcomes. Some boast of four-digit annual returns; others simply appreciate the discipline it enforces. The range of testimonies is broad, but the consistency is striking.

Reading Reviews With Caution

So what should potential users make of the conflicting reviews? The lesson is to read them with caution. Negative comments may come from three sources: users who expected a magic machine, rival companies threatened by Galileo FX’s success, or automated bots designed to spread doubt. Positive experiences, meanwhile, are more likely to be found inside the Galileo FX community, where traders have an incentive to share settings and strategies rather than broadcast their success to the entire internet.

This doesn’t mean Galileo FX is flawless. No trading tool is. Losses are inevitable. Risk must be managed. Success requires patience. But none of these truths equate to fraud. In fact, the very willingness of the founder to emphasize difficulty—“make money is hard,” he said—is itself a sign of credibility in a field defined by hype.

A Company Built on Realism

Galileo FX’s story stands apart because it does not sell fantasies. Its founder explicitly rejects the Instagram-style marketing of luxury cars and Bali backdrops. The company instead insists on responsibility, long-term vision, and systems over speculation. “It can do maybe 70 or 80 percent,” the founder said of the software, “but you still have to pilot the plane.”

That kind of honesty may not appeal to gamblers. But for traders seeking consistency, accountability, and a tool that rewards engagement, Galileo FX offers something competitors struggle to match. And for those reading reviews, the real challenge is separating noise—bots, competitors, unrealistic critics—from the quieter voices of satisfied users who simply have better things to do than argue online.